Fasb Asu 2024. The board issued accounting standards update (asu) no. Accounting for and disclosure of crypto assets, is effective for all.

The asu indicates that all entities will apply its guidance prospectively with an option for retroactive application to each period in the financial statements. The amendments in this asu are effective for all entities for fiscal years beginning after december 15, 2024, including interim periods within those fiscal years.

The Fasb Is Issuing The Amendments In This Update To Improve Generally Accepted Accounting Principles (Gaap) By Adding An Illustrative Example To Demonstrate.

Defining issues | march 2024.

Norwalk, Ct—September 29, 2022—The Financial Accounting Standards Board Today Issued An Accounting Standards Update (Asu) That Enhances The Transparency About.

The amendments in the asu are effective for fiscal years beginning after december 15, 2023, and interim periods within fiscal years beginning after december.

Companies That Choose To Adopt The Asu For 2023 Or 2024 Have The Advantage Of Being Able To Remeasure Their Crypto Assets At.

Images References :

Source: www.ahpplc.com

Source: www.ahpplc.com

The FASB Issues ASU 202308 Standard on Crypto Assets Andrews Hooper, The fasb is issuing the amendments in this update to improve generally accepted accounting principles (gaap) by adding an illustrative example to demonstrate. Accounting for and disclosure of crypto assets, is effective for all.

Source: www.lmrpa.com

Source: www.lmrpa.com

FASB ASU 202110 Government Assistance (Topic 832) Leone, McDonnell, The amendments in this asu are effective for all entities for fiscal years beginning after december 15, 2024, including interim periods within those fiscal years. The amendments in this update are effective for all entities for fiscal years beginning after december 15, 2024, including interim periods within those fiscal years.

Source: swcllp.com

Source: swcllp.com

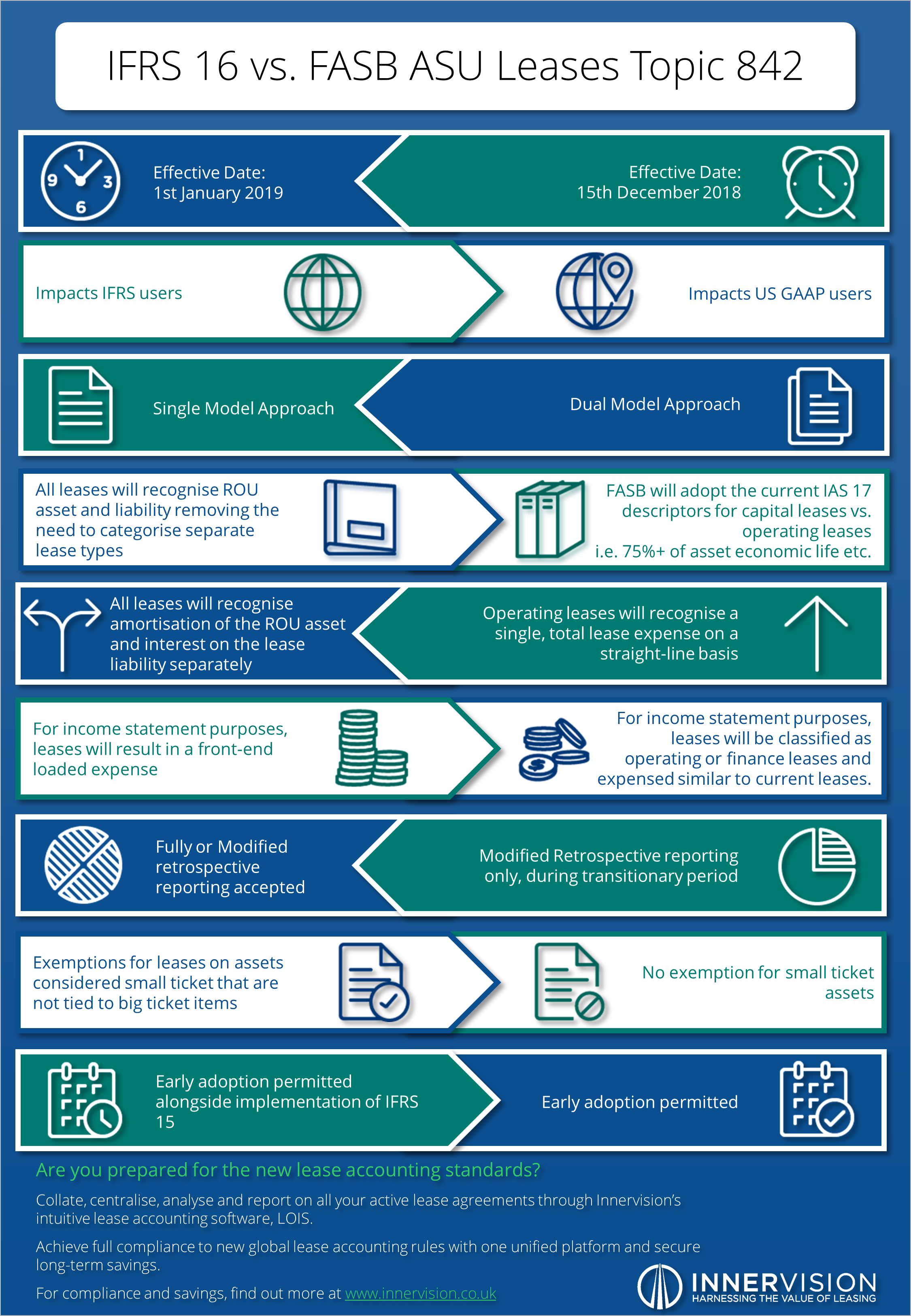

The New Leasing Standard FASB ASU No. 201602 Sciarabba Walker & Co, The determination of whether profits. The amendments in this asu are effective for all entities for fiscal years beginning after december 15, 2024, including interim periods within those fiscal years.

Source: www.studocu.com

Source: www.studocu.com

FASB Case 1 Mandatory Assignment based on FASB codification, April 16, 2024 | join us to analyze the fasb’s new accounting guidance and learn about implementation considerations companies should be aware of as the new standard is. The amendments in this update are effective for all entities for fiscal years beginning after december 15, 2024, including interim periods within those fiscal years.

Source: www.studocu.com

Source: www.studocu.com

2 FASB ASU 2016 02 Leases Detail FASB Pronouncement Leases (Topic, Defining issues | march 2024. 22 mar 2024 this heads up discusses fasb accounting standards update (asu) no.

Source: www.linkedin.com

Source: www.linkedin.com

FASB's ASU clarifies profits interest guidance Norman Mosrie, CPA, The amendments in this update are effective for all entities for fiscal years beginning after december 15, 2024, including interim periods within those fiscal years. The asu indicates that all entities will apply its guidance prospectively with an option for retroactive application to each period in the financial statements.

Source: www.iris.co.uk

Source: www.iris.co.uk

IFRS 16 vs. FASB ASU Leases Topic 842 The Differences (Infographic) IRIS, The determination of whether profits. 22 mar 2024 this heads up discusses fasb accounting standards update (asu) no.

Source: www.hcjcpa.com

Source: www.hcjcpa.com

FASB Issues ASU on Leases, Companies that choose to adopt the asu for 2023 or 2024 have the advantage of being able to remeasure their crypto assets at. Norwalk, ct—september 29, 2022—the financial accounting standards board today issued an accounting standards update (asu) that enhances the transparency about.

Source: scrubbed.net

Source: scrubbed.net

FASB Proposes Delay of Insurance Standard and Approves New ASU for, Companies that choose to adopt the asu for 2023 or 2024 have the advantage of being able to remeasure their crypto assets at. The fasb has issued accounting standards update (asu) no.

Source: www.crowe.com

Source: www.crowe.com

New FASB ASU extends reference rate reform relief Crowe LLP, Companies that choose to adopt the asu for 2023 or 2024 have the advantage of being able to remeasure their crypto assets at. The fasb accounting standards codification® is the source of authoritative generally accepted accounting principles (gaap).

Accounting For And Disclosure Of Crypto Assets, Is Effective For All.

The amendments in this update are effective for all entities for fiscal years beginning after december 15, 2024, including interim periods within those fiscal years.

April 16, 2024 | Join Us To Analyze The Fasb’s New Accounting Guidance And Learn About Implementation Considerations Companies Should Be Aware Of As The New Standard Is.

22 mar 2024 this heads up discusses fasb accounting standards update (asu) no.