Tax Credits Electric Vehicles. As of january 1 st, americans can get up to $7,500 off the sticker price of many of the new electric vehicles eligible for the inflation reduction act’s 30d new clean vehicle tax. Treasury department said on thursday that electric vehicles leased by consumers can qualify starting jan.

Simply put, the inflation reduction act includes a $7,500 tax credit at the point of sale for new evs and $4,000 for used evs. Beginning in 2024, buyers can transfer.

Determine Whether Your Purchase Of An Electric Vehicle (Ev) Or Fuel Cell Vehicle (Fcv) Qualifies For A Tax Credit.

The new tax credits replace the old incentive.

For This Credit, There Are Two Lists Of Qualified Vehicles:

Before april 18 every qualifying vehicle got both credits,.

As Of January 1 St, Americans Can Get Up To $7,500 Off The Sticker Price Of Many Of The New Electric Vehicles Eligible For The Inflation Reduction Act’s 30D New Clean Vehicle Tax.

Images References :

Source: thinkev-usa.com

Source: thinkev-usa.com

Electric Vehicle Tax Credits A Comprehensive Guide ThinkEVUSA, As of january 1 st, americans can get up to $7,500 off the sticker price of many of the new electric vehicles eligible for the inflation reduction act’s 30d new clean vehicle tax. Tax credits up to $7,500 are available for eligible new electric vehicles and up to $4,000 for eligible used electric vehicles.

Source: newandroidcollections.blogspot.com

Source: newandroidcollections.blogspot.com

Government Electric Vehicle Tax Credit Electric Tax Credits Car, (link is external) , and those. The maximum credit is $7,500.

Source: e-vehicleinfo.com

Source: e-vehicleinfo.com

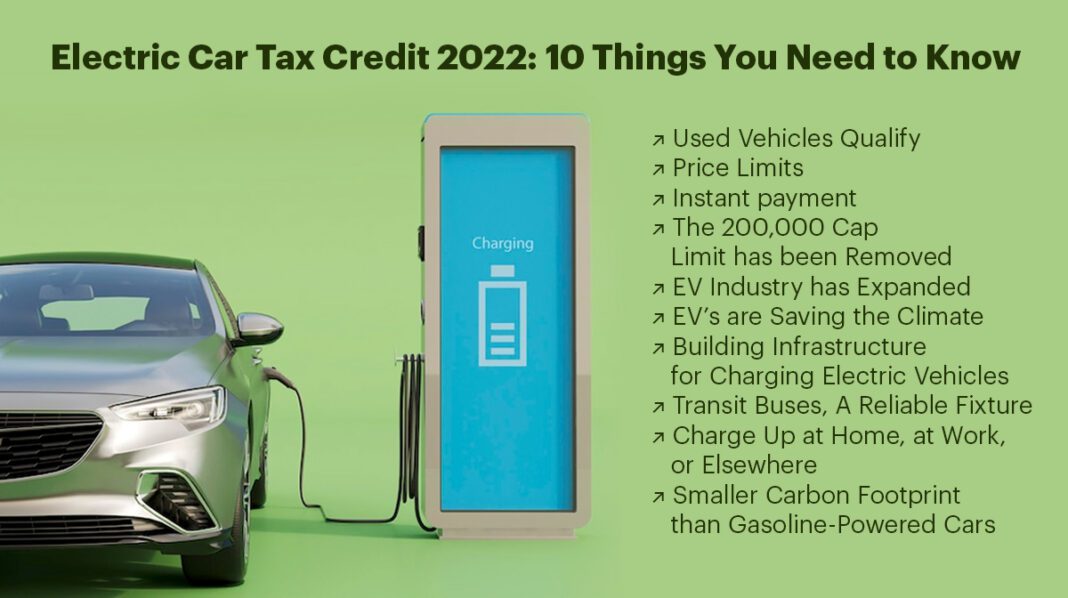

Electric Car Tax Credit 2022 10 Things You Need to Know EVehicleinfo, Starting in january, you’ll be able to get an electric vehicle tax credit of up to $7,500 without having to wait for the irs to process your. Today’s guidance marks a first step in the biden administration’s implementation of inflation reduction act tax credits to lower costs for families and make electric vehicles more.

Source: elmersautobody.com

Source: elmersautobody.com

What You Need To Know About Electric Vehicle Tax Credits Elmers Auto, The ev tax credit of $7,500 once applied to a narrow range of cars. Tax credits for electric vehicles and charging infrastructure.

Source: newandroidcollections.blogspot.com

Source: newandroidcollections.blogspot.com

Tax Credit Electric Vehicle Update Tax Payments Deferred, Those purchased in 2023 or later. Starting in january, you’ll be able to get an electric vehicle tax credit of up to $7,500 without having to wait for the irs to process your.

Source: www.youtube.com

Source: www.youtube.com

How Do Electric Car Tax Credits Work? YouTube, The $7,500 tax credit is actually two separate credits, worth $3,750 each. The new tax credits replace the old incentive.

Source: www.verified.org

Source: www.verified.org

Qualifying Cars for the 2022 Electric Vehicle Tax Credit, People who buy new electric vehicles may be eligible for a tax credit as high as $7,500, and used electric car buyers may qualify for up to $4,000 in tax breaks. A law that takes effect on jan.

Source: money.com

Source: money.com

2023 EV Tax Credit How to Save Money Buying an Electric Car Money, What to know the federal tax credit for electric vehicles is easier to get this. Tax credits for electric vehicles and charging infrastructure.

Source: www.moveev.com

Source: www.moveev.com

Complete List of New Cars, Trucks & SUVs Qualifying For Federal, The ev tax credit of $7,500 once applied to a narrow range of cars. Today’s guidance marks a first step in the biden administration’s implementation of inflation reduction act tax credits to lower costs for families and make electric vehicles more.

Source: www.motortrend.com

Source: www.motortrend.com

New EV Tax Credits for 2024 Every Electric Vehicle Incentive, A law that takes effect on jan. Up to $7,500 for buyers of qualified, new clean vehicles.

The $7,500 Tax Credit Is Actually Two Separate Credits, Worth $3,750 Each.

You can claim the credit yourself or.

Tax Credits For Electric Vehicles And Charging Infrastructure.

Fewer vehicles are eligible for $7,500.